As a business owner, you’re at the top of your game and an expert in your field.

However, it doesn’t mean you automatically know the ins and outs of business law. Nor should you have to.

When you engage Fox and Thomas to handle the legalities of your business, it leaves you with more time to run your business and do what you love most.

Our team has extensive experience handling the legal needs of small to medium enterprises, family businesses and significant corporations across Queensland and New South Wales. No matter the size of the issue or the scale of your business, our business law experts are here to provide you with solutions in a timely, professional manner.

If you haven’t started your business yet, the best way to get ahead is to plan for the future. Our end-to-end business law services allow us to help everyone – no matter what stage they’re in. So, whether you’re in the planning phases of opening a new business or trying to develop a succession plan to exit one, or anywhere in between, we’re here to help.

Let our team of business law experts handle the difficult and uncertain stuff for you. From employment contracts right through to mergers and acquisitions or intrafamily loans, our team has you covered.

Family re-arrangements & corporate structuring

If you are purchasing assets, starting a new business or investment or expanding your existing assets, business or investments it is important to consider the structure in which these assets are held. We can work with you and your advisors to develop a strategy and establish a new structure (or expand on an existing structure) that works for you; taking into account your risk appetite, the taxation and duty implications and your long term succession planning goals.

Different types of structures

Sole trader/personal ownership

The acquisition of a business as a sole trader usually requires little or no formal documentation other than that required to register a business name and of course all necessary tax registrations; namely, TFN, ABN, GST and payroll (if appropriate).

As a sole trader, the business is usually easier and less expensive to run from an administration and accounting viewpoint.

We can advise you on the risks associated with being a sole trader. One of the main risks is that the sole trader is personally liable for all of the debts of the business.

Partnerships

A partnership exists where there is a relationship between people carrying on business in common with a view to making a profit.

We can help you prepare a partnership agreement to set out your respective rights and obligations in running the partnership. We can also advise you on who is responsible for the liabilities of the partnership and what happens on the death, incapacity or bankruptcy of a partner to the partnership.

Joint ventures

An unincorporated joint venture differs from that of a partnership as the parties to the venture often desire to avoid joint liability for the debts of the enterprise and to obtain the taxation benefits that can flow from the separate tax treatment of each venturer.

We can assist you in preparing a joint venture agreement and advise you of the taxation implications.

Trusts

There are different types of trusts, including unit trusts and discretionary trusts. We can advise you on which type of trust might be best for you in your circumstance.

A trust must have a trust fund or property, there must be a trustee and there must be beneficiaries. We can prepare a formal trust deed for you, which will set out the terms of the trust.

The common roles in a trust include a trustee, settlor, appointor/principal, specified beneficiaries and sometimes a guardian. We can advise you on what is involved with each of these roles and who you should consider appointing to these roles.

One of the major advantages of a trust structure is its flexibility. A trust structure (particularly a discretionary trust) allows the parties the opportunity to assess their tax position on a year by year basis and to distribute income in a different way each year (if appropriate), so as to achieve the most effective after tax distribution of income.

We can advise you on the taxation treatment of trusts and the implications of not distributing trust income. It is important to realise that the trust itself is not a separate legal entity. It is the trustee (which can be a person or a company) which holds the trust property and is responsible for trust liabilities.

Companies

A private company is a separate legal entity that can be used to acquire assets or a business. It can also be appointed a trustee of a trust known as a “corporate trustee”.

We can set up a new private company for you or make changes to the office holders or share holders in your existing company.

The roles in a company include directors, a secretary and shareholders. On establishment of a private company, the shareholders are issued shares in the company and are required to pay the amount for those shares. The directors of a company control and make day to day decisions for the business.

Directors of a company should be aware of their responsibilities and duties, for example their skill, care and diligence, prevention of insolvent trading, employment law and workplace health and safety.

It is important you consider who the directors of your company will be, particularly who is exposed if something does go wrong. We can advise you about director duties and assist you in considering who might be appropriate for the director role/s.

Bank guarantee and indemnity

Bank guarantees and indemnities are commonly used by banks as a form of security to aid a customer borrowing funds from the bank.

A third party (the guarantor) guarantees the borrower’s obligations under the loan agreement by providing a guarantee and indemnity. In doing so, the guarantor promises to fulfil the borrower’s obligations in the event the borrower defaults under the loan agreement, and to indemnify the bank against any loss it might suffer as a result.

A guarantor can be any one or more of a family member, spouse or related business associate /entity of the borrower.

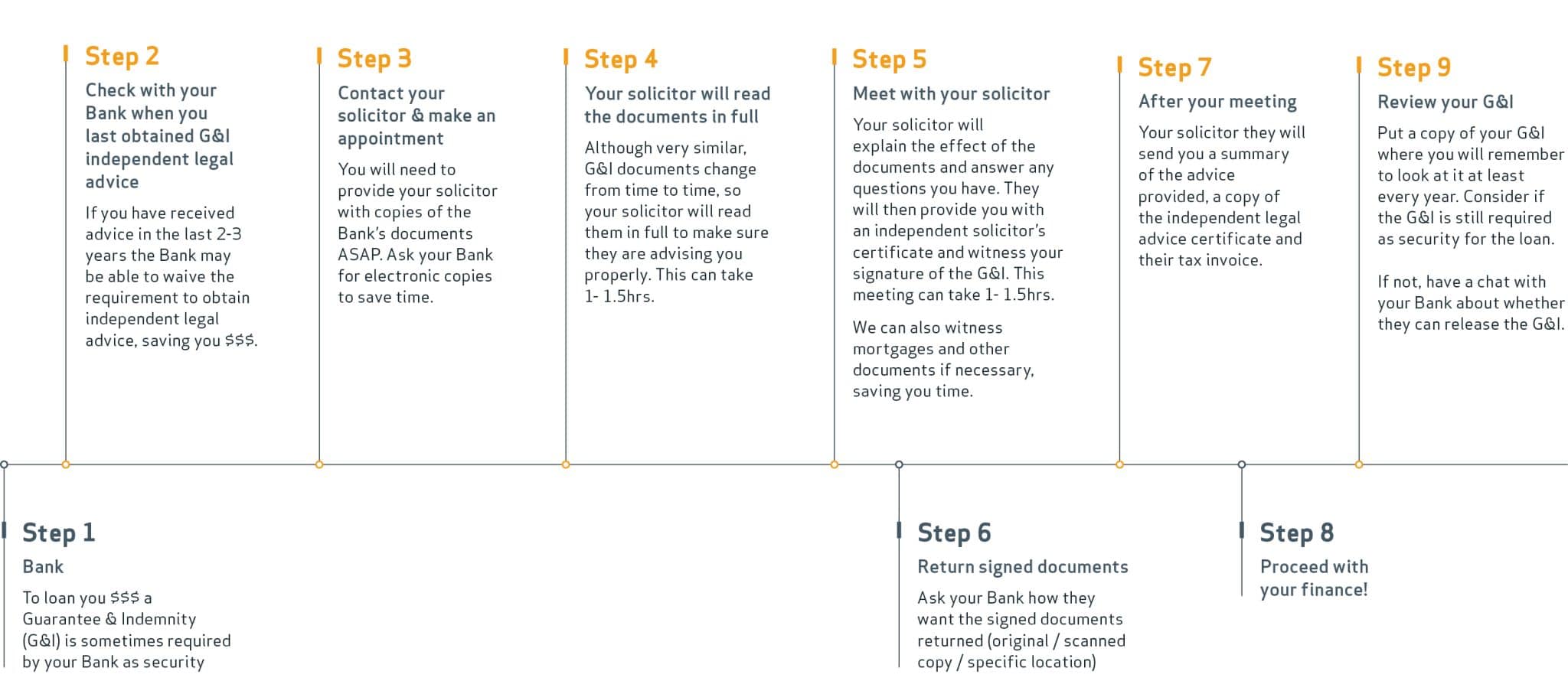

Before the guarantor signs the guarantee and indemnity, banks will generally require an independent solicitor’s certificate of advice to ensure that the guarantor understands and acknowledges the risks involved with providing the guarantee and indemnity.

At Fox and Thomas, we regularly provide independent solicitor’s certificates of advice for bank guarantees and indemnities. This involves us reviewing the documents provided by the bank, meeting with you (the guarantor) and providing you with comprehensive advice. It is important that this process is done properly, otherwise the guarantee and indemnity may later be found to be unenforceable.

Guarantee & Indemnity Independent Legal Advice Process

Intrafamily loans

There is a common trend these days of parents lending funds to their adult children. Although this sounds quite simple, it is advisable and beneficial to get the ‘loan’ in writing to avoid any disagreements or complications in the future, particularly in the context of a child’s relationship breakdown or the parents’ estate planning.

Succession Planning

Operating and growing a business takes hard work. Whether you are a farmer, franchisee or food processor, you build up a lot of wealth in your business as the years (or even decades) go by. This is why it is so important that you have a plan in place for how the business is to carry on, when it comes time for you to exit the business.

At Fox and Thomas, we can help you achieve this with a detailed succession plan which allows you to transition out of the business with financial security, minimise the tax and duty costs, and ensure the business can continue to grow and expand for the next generation.

Plan

To begin the transition out of your business, planning ahead is vital to make sure the right action is taken at the right time to get the best result for all involved. You need to know what your goals are for the future to prepare and include those goals in your plan. Things to keep in mind when starting to plan:

- Understanding the business in its current state

- Ongoing objectives of the business

- Existing contracts and foreseeing any risks involved with the transition

- Future events that need to be planned for after the transition

The transition of the ownership or control of a business can take months or even years. In our experience, the sooner you start, the easier the transition is.

Communication

Communication is important to make sure everyone involved feels they are part of a united team, to provide a positive impact and to ensure morale and engagement with current employees and your business contacts stays high.

We then need to discuss the matter of ‘family’ vs ‘non-family’. If you have a family business, it will help to start discussing your long-term plans with your children and educating them about your business.

Teamwork

The inclusion of your accountant, solicitor, banker and other financial advisers in your succession plan are key to ensuring you arrive at a succession plan which is financially viable and that all parties are happy with. Keeping parties that are important to the business informed will maintain trust and loyalty within the business.

Review

A successful succession plan is one that is flexible and can be revised to accommodate potential changes. First, we need to do an assessment of structural positions, things like current staff/family dynamics, current assets, existing business operating, finances and asset holdings. Ensuring we have all areas covered allows for a smooth plan that is easy to alter when needed.

Document

Once you have the ideas, goals and position set out from your business review, we can start to document and clearly define the responsibilities needed for the transition. You need to take into consideration documents that set out the:

- transfer of control or ownership of assets

- debt of the business

- predicted timeframes

- restructuring of existing entities / creation of new entities

- the payment of money to certain parties

- superannuation of family members

Implementation

It is important that the succession plan is implemented, maintained and reviewed with regular meetings to ensure the transition is progressing. Regular meetings will promote communication, reduce uncertainty, identify issues, generate solutions and generally keep the succession plan on track.

Advice for Employment

At Fox and Thomas, we understand just how integral employees are to a business and are particularly well versed in dealing with employment issues against the backdrop of the agribusiness industry. We assist employers in respect of employment contracts, termination of employees and dealing with employees and their entitlements in the sale or purchase of a business. We also assist employees in the protection of the rights, review of their employment contracts and assisting them with any post-employment contractual obligations.

Employment contracts

Having a well drafted employment contract is essential to setting out the relationship between you as the employer and your employee. It does not matter whether you are a small business with one employee or a large corporation with hundreds of employees.

There are a wide range of issues to consider when preparing employment contracts including:

- Which award applies to the employee? Remember that the minimum conditions provided for in the National Employment Standards or the appropriate award cannot be overridden or contracted out of by an employment contract.

- The employee’s salary and leave entitlements.

- What is the type of the employment? E.g. full-time, part-time, causal, fixed term.

- Are there any benefits the employee is entitled to over and above the award? E.g. higher salary, extra leave entitlements, training provided?

- If the employee is being provided with accommodation (as is often the case with farming employers), who is responsible for utilities etc?

- Arrangements for the termination of the employment relationship by either party. E.g. notice period for resignations, return of employer property such as vehicles, laptops and mobile phones.

- Confidentiality requirements.

- Post-employment restraint of trade provisions. It is important that any restraint is reasonable in light of the employee’s position.

Employment contracts should be regularly reviewed in line with performance or annual reviews and amended or resigned as required.

Termination of employment

Terminating an employee is a difficult process and if not done correctly it can have significant implications for you as an employer.

We can guide you through the process whether the termination is due to performance issues, redundancy or the sale of a business to ensure you comply with your legal obligations as an employer.

Your experts in Business Services:

Michael Cowley

Director

Email Michael

Norman Fox

Consultant

Email Norman

Melissa Hill

Senior Associate

Email Melissa

Lauren Farrelly

Senior Associate

Email Lauren

Shannon Talty

Senior Associate

Email Shannon

Nicole Gittins

Paralegal

Email Nicole

Georgina Fernie

Paralegal

Email Georgina

Siggy Walsh

Paralegal

Email Siggy

Jemma Biggs

Paralegal

Email Jemma

The Latest Business Law News

Employment agreements with your children

So, your child has finished school, university or a trade and now seems like a great time for the now adult children to come back […]

June 25, 2024

Deregistering a company

Before deregistering a company, there are several important steps you should take to ensure that the process is carried out correctly and legally. Here are […]

April 18, 2024

De-registering a company? Avoid these potential pitfalls!

Failing to perform the necessary steps before deregistering a company can have significant consequences. These include: Legal Issues: If you don’t notify stakeholders or fulfill […]

April 4, 2024